Crypto staking was born and gained a lot of attraction from investors. It set up a new way for passive income in the cryptocurrency space. What exactly is staking, how can you stake and what are the best staking coins in 2023?

Let’s deep dive into the staking. I chose the top staking coins for 2023 based on their performance and my own fundamental research. I will give you an overview of Proof of Stake to better understand how you can start staking.

Decentralized Finance (DeFi) had a great performance in the past, and many predict that this year in 2023/2024 will be the year of staking coins. Crypto staking is also a strategy how to gain a profit even when the bear cycle appears in the cryptocurrency market.

What Is Crypto Staking

Staking usually involves keeping funds in a wallet and performing various network functions (such as validating transactions) to receive staking rewards. Staking is the act of locking cryptocurrencies to receive rewards.

To stake = To hold

Staking networks use Proof of Stake as their consensus algorithm.

A staking pool allows stakeholders to combine their computational power and increase their rewards.

To understand better what staking is, you should understand how Proof of Stake works.

Proof of Stake

Proof of Stake consensus algorithm was introduced in 2011 as a way how to avoid heavy usage of resources needed to perform mining during Proof of Work.

Proof of Work (PoW) uses computational resources to solve cryptographic problems to secure the network and validate blocks. Bitcoin is a cryptocurrency based on PoW.

Proof of Stake (PoS) algorithm uses an election process that selects the node that will validate each block. This election process can use a number of factors such as randomization, the number of coins being held in the staking wallet, the staking age of coins, or other factors.

One of the earliest projects that runs on Proof of Stake was Peercoin. Its network was launched with a hybrid PoW/PoS mechanism.

How Does Staking Work

Proof of Stake chains produce and validate new blocks through the process of staking. This is a big difference from Proof of Work where blockchains rely on mining to add new blocks to the blockchain.

During staking the coins are locked in a wallet and over time more coins are added to that wallet as a reward.

The more coins are being staked, the bigger is the staking reward.

What Are Staking Coins

It is quite similar to how someone would receive interest for holding money in a bank account or giving it to the bank to invest. Staking is being compared to bond interest payments or dividend payouts.

How Are Staking Rewards Calculated

There are a few factors that influence how much reward the validator earns.

- How many coins you are staking.

- How long have you been actively staking.

- How many coins are staked on the network in total.

- The inflation rate.

Earn Passive Income with Crypto

According to Staking Rewards, there are more than 166 yield-bearing assets with an average reward rate of 18.61%.

Why I Should Start Staking

Anyone is interested in earning extra income, moreover if it is a passive stream. Diving deeper into staking will push you into evaluating cryptocurrencies and that’s a great way how to learn more about blockchain and crypto start-ups.

- Generate extra income

- An additional way how to invest in crypto

Some investors are looking for higher profits and choose a strategy with a crypto trading bot instead of staking and holding coins. Must read: Best crypto trading bots.

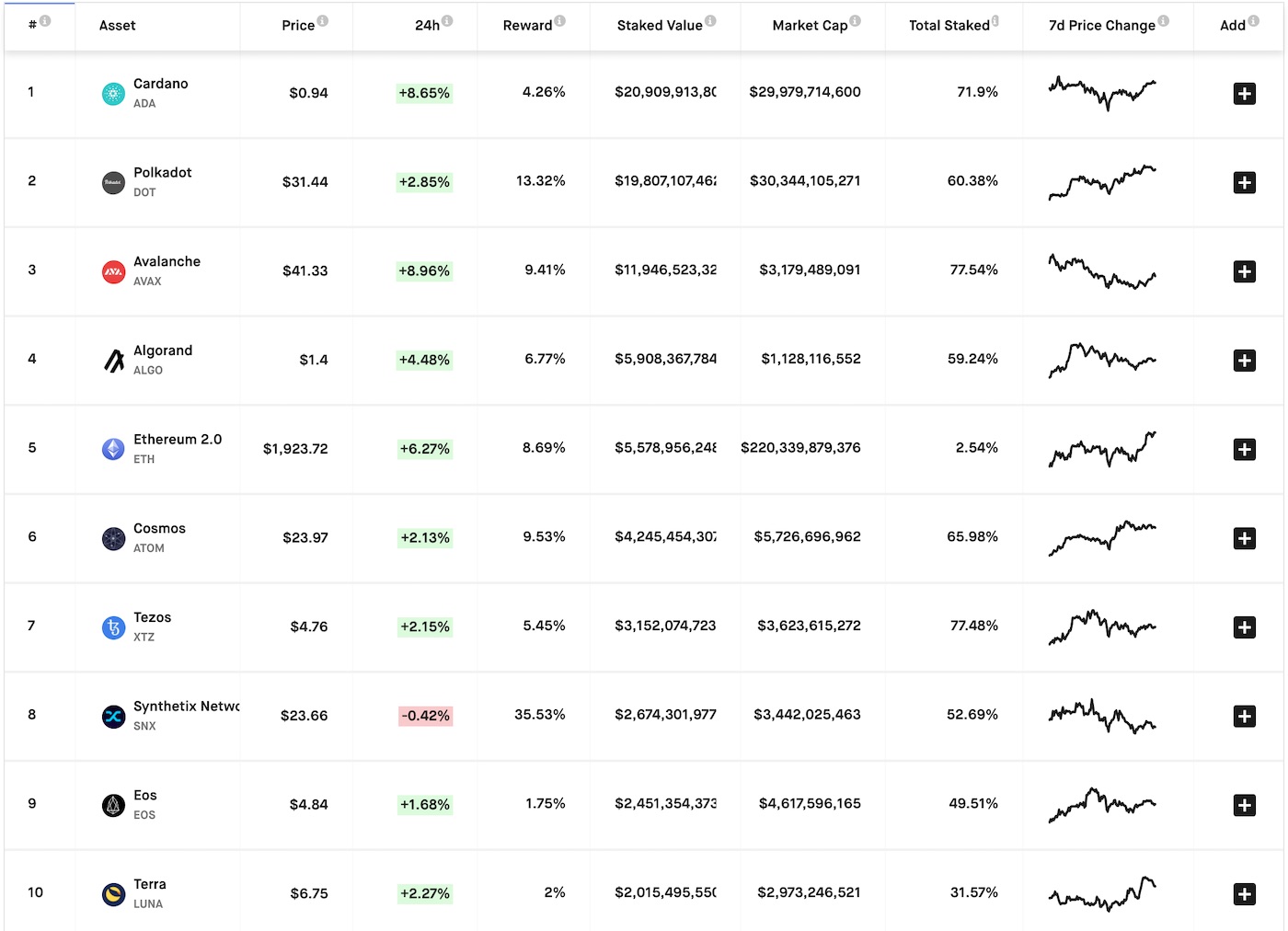

Best Staking Coins in 2023

There are many options for users who want to earn passive income with cryptocurrencies. We cover below some of the biggest cryptocurrencies offering staking rewards.

- Ethereum (ETH)

- Solana (SOL)

- Avalanche (AVAX)

- Tezos (TZX)

- Cardano (ADA)

- Terra (LUNA)

- Polkadot (DOT)

- Binance Smart Chain (BNB)

- Cosmos Hub (ATOM)

- Near (NEAR)

- Internet Protocol (ICP)

There is no point in staking coins that have no future and lose their value significantly. You may stake more coins but even if you sell them you won’t cover your losses due to the coin price decrease on the market.

Ethereum 2.0 (ETH)

Ethereum is one of the most popular and hottest staking options.

You’ll need 32 ETH to become a full validator or some ETH to join a staking pool. You’ll also need to run an ‘Eth1’ or mainnet client. This process, known as proof-of-stake, is being introduced by the Beacon Chain.

The total amount of ether locked in Ethereum 2.0 has recently surpassed $3 billions, according to data from Etherscan. As of press time, ether was trading at $1,920.

The annual reward for staking ETH ranges between 7 – 10%.

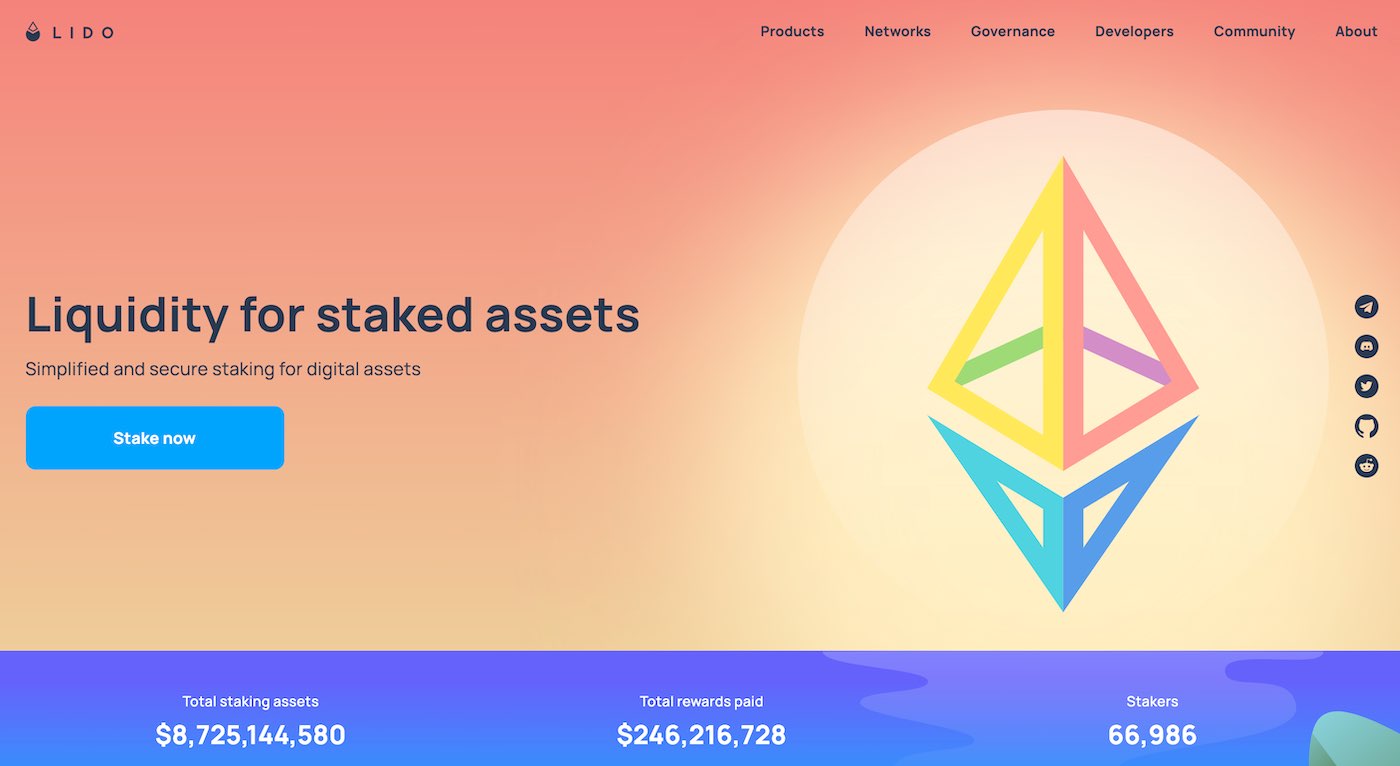

As decentralized finance (DeFi) growing, there are more options how you can stake Ethereum, even without the necessity of staking 32 ETH. If you are a small holder and have less than 32 ETH, you can still stake ETH on platforms such as Lido or Rocketpool.

You can stake Ethereum on Lido.fi with just 1 ETH. It is great options for small holders. Lido is one of the most popular a favorite platform for Ethereum staking.

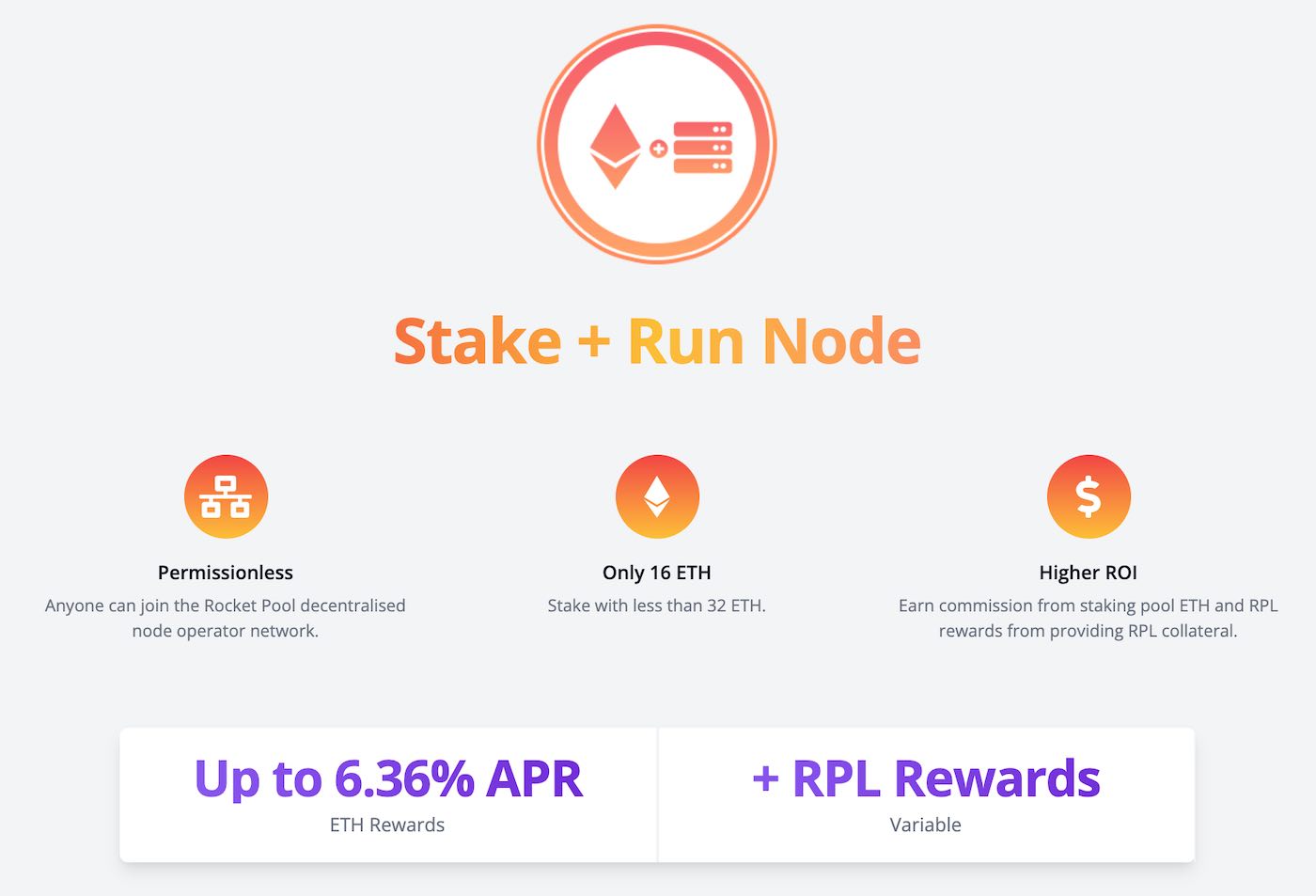

Another popular service is RocketPool. It seems to be more decentralized but the platform is quite new and many old ETH hodlers found Lido more stable.

RocketPool has the advantage of better staking rewards for investors with 16 ETH.

If you have 16 ETH you can stake Ethereum and run node which gives you more than 6% APR. It is one of the best performances for small amount ETH holders on the market.

Solana (SOL)

Staking your SOL tokens on Solana is the best way you can help secure the world’s highest-performing blockchain network. You also will earn rewards!

You can earn up to 6% by delegating SOL.

SolFlare is an official platform and wallet that provides you with staking options.

There is no required minimum amount to stake and the rewards are automatically reinvested.

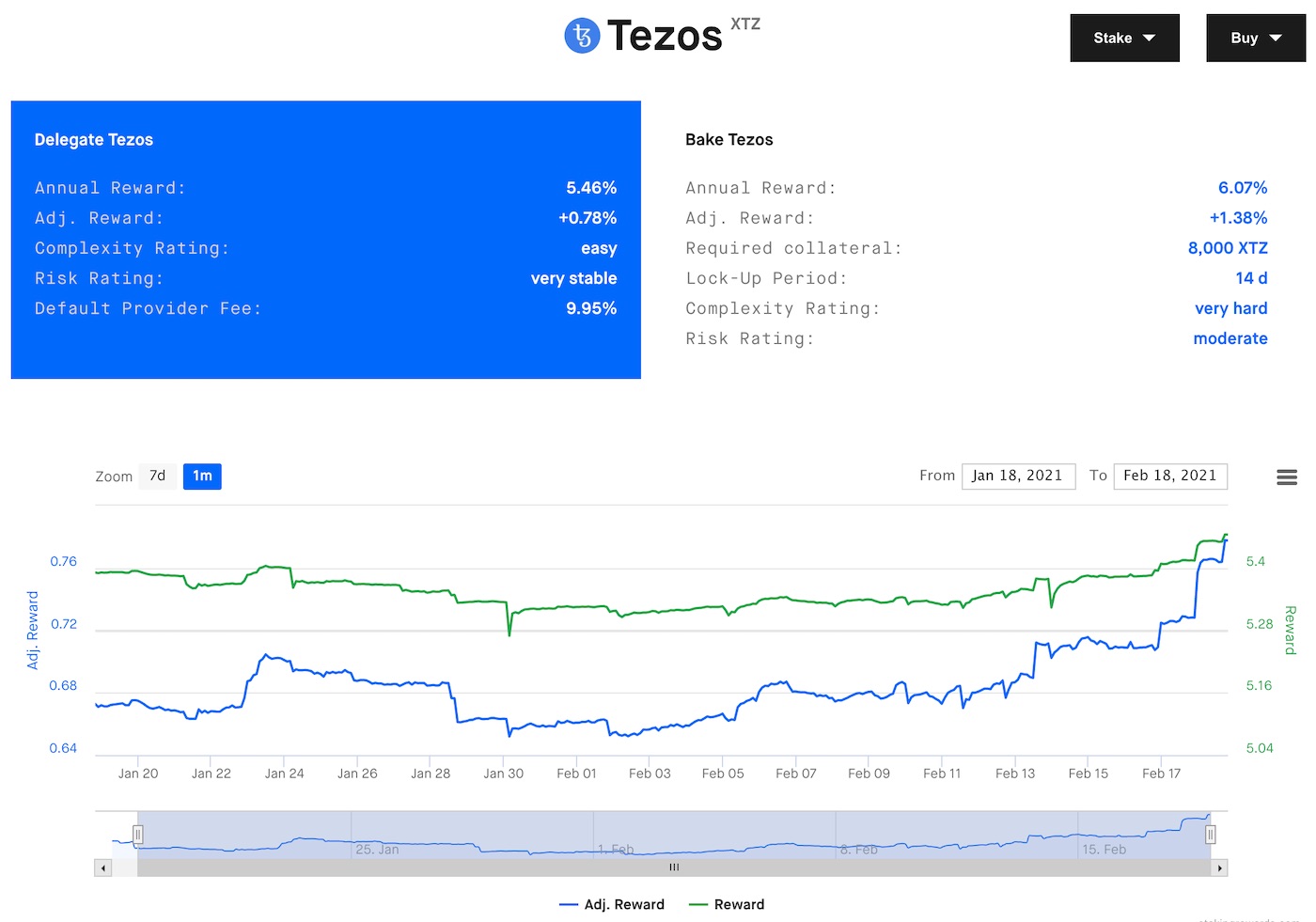

Tezos (XTZ)

Tezos blockchain implements a version of Proof-of-Stake called Liquid Proof-of-Stake (LPoS). There are two ways to earn passive income and staking rewards with your Tezos.

- Delegating Tezos

- Baking Tezos

Tezos calls the staking process baking. To become an independent staker (baking) on Tezos, a user needs to hold 8,000 XTZ coins and run a full node.

There are third-party services that allow users to join with a smaller amount of coins and take advantage of the staking process. It is delegating Tezos. Delegating is a secure process while investor keeps control over his private keys.

Annual percentage yield on XTZ staking ranges anywhere from 5 – 6 percent.

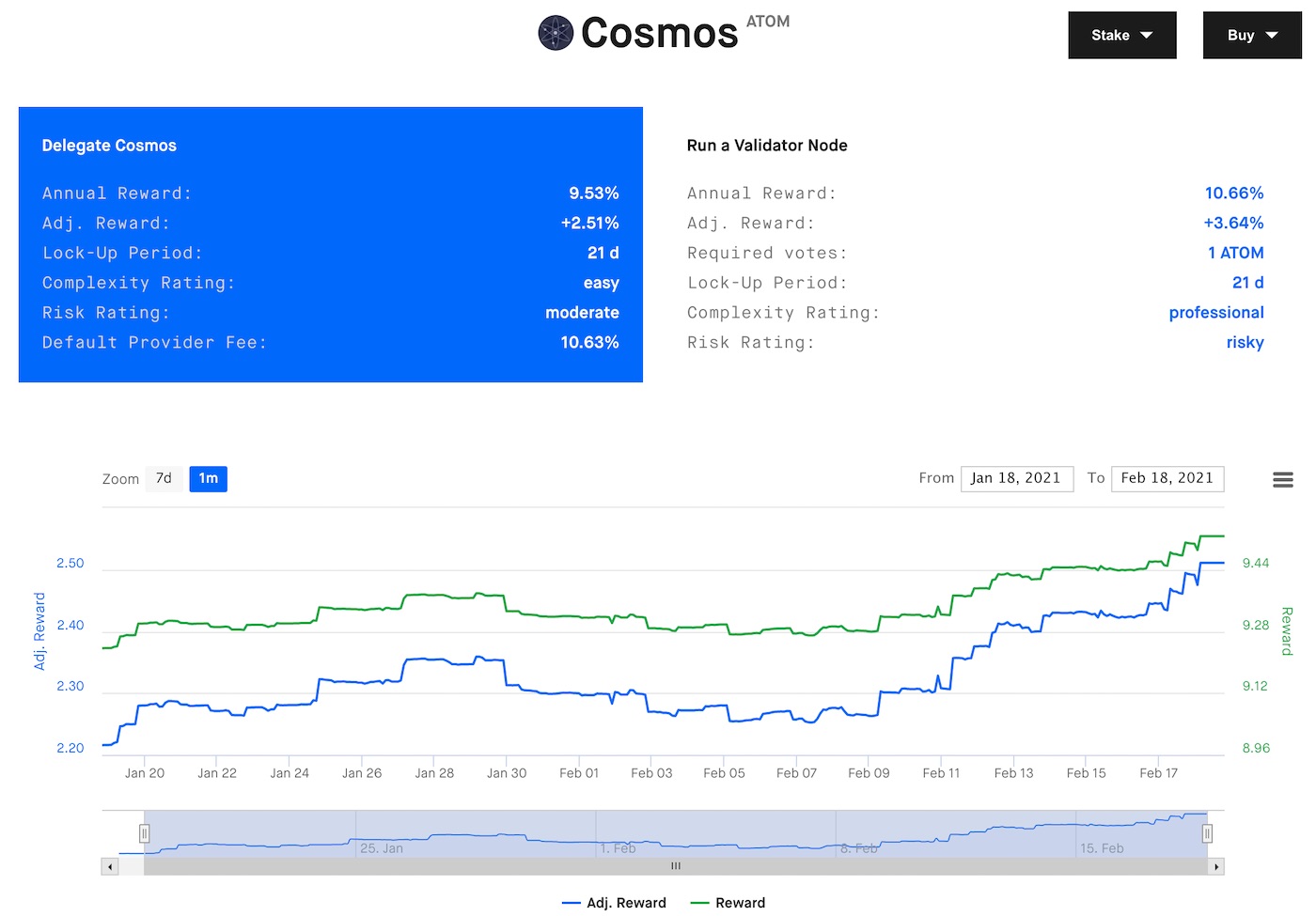

Cosmos (ATOM)

Cosmos is a decentralized network enabling data exchanges between different blockchains. The project started in 2017 as an ICO with its vision to create an internet of blockchains.

Cosmos blockchain consensus is achieved via Tendermint.

The annual reward for staking ATOM ranges between 8 – 11%.

KAVA (KAVA)

Kava is a DeFi lending platform for digital assets. It is a multi-chain DeFi Lending platform that offers USDX stablecoin loans and Chainlink oracle data to major blockchain.

Kava blockchain consensus is achieved via Tendermint.

The annual reward for staking KAVA ranges between 4 – 6%.

Vechain (VET)

VeChain is a cryptocurrency and smart contracts platform focused on supply chain management. VeChain blockchain consensus is achieved via Proof of Stake + Masternodes.

The public blockchain derives its value from activities created by members within the ecosystem solving real-world economic problems.

The annual reward for staking VET ranges between 1 – 2%.

Algorand (ALGO)

Algorand is an open-source public blockchain based on a pure proof-of-stake consensus protocol that supports scalability. Algorand blockchain consensus is achieved via Pure Proof of Stake.

The annual reward for staking ALGO ranges between 5 – 7%.

Cardano (ADA)

Cardano uses a PoS consensus mechanism called Ouroboros. By staking ADA, users can support the network and earn rewards in return.

Staking Cardano (ADA) is a way for users to participate in the security and validation of the Cardano blockchain while earning rewards. Cardano uses a Proof of Stake (PoS) consensus mechanism called Ouroboros, which allows users to delegate their ADA holdings to stake pools that validate transactions and produce new blocks. Here’s more information about staking Cardano:

- Delegation: Users can delegate their ADA tokens to a stake pool without transferring ownership of the tokens. This means that users maintain control of their funds while contributing to the network’s security and stability.

- Stake Pools: Stake pools are operated by experienced node operators with the technical knowledge and infrastructure to ensure the network’s reliability. By delegating ADA to a stake pool, users contribute to the pool’s overall stake, increasing its chances of being selected to produce new blocks.

- Rewards: Staking rewards are generated when a stake pool successfully validates transactions and produces new blocks. The rewards are distributed proportionally among the delegators based on the amount of ADA they have staked. Staking rewards are typically paid out every five days (an epoch).

- Choosing a Stake Pool: When selecting a stake pool, consider factors such as the pool’s performance, fees, and saturation level. A pool with a high-performance rate, low fees, and a saturation level below 100% is generally more attractive. Remember that over-saturated pools may yield lower rewards due to the distribution of rewards among more delegators.

- Flexibility: Users can change stake pools, delegate to multiple pools, or stop delegating at any time without penalties. This flexibility allows users to optimize their staking strategy and maximize their rewards.

It’s essential to conduct thorough research before choosing a stake pool and to be aware of the risks involved in staking, such as price volatility and potential loss of staked coins due to malicious activities or stake pool issues.

Polkadot (DOT)

Polkadot employs a Nominated Proof of Stake (NPoS) mechanism. Users can stake their DOT tokens to support validators and receive staking rewards.

Staking Polkadot (DOT) is a process where users can participate in the security and validation of the Polkadot blockchain while earning rewards. Polkadot employs a Nominated Proof of Stake (NPoS) consensus mechanism, allowing users to nominate or become validators themselves. Here’s more information about staking Polkadot:

- Validators: Validators play a crucial role in the Polkadot ecosystem by validating new blocks, ensuring transactions are accurate, and maintaining network security. To become a validator, users must have a significant amount of DOT tokens and adequate technical knowledge to run a validator node.

- Nominators: Nominators support the network by selecting trustworthy validators and backing them with their own DOT tokens. By doing so, nominators contribute to the security and stability of the network and earn rewards in return.

- Staking Rewards: Staking rewards are generated when validators successfully validate transactions and produce new blocks. The rewards are distributed among both validators and nominators based on the amount of DOT tokens they have staked.

- Bonding and Unbonding: To stake DOT tokens, users need to bond them, locking the tokens for a period. Once bonded, users can nominate validators or run their validator node. If users want to stop staking and access their tokens, they must initiate an unbonding process, which takes 28 days to complete.

- Risks and Slashing: Polkadot employs a slashing mechanism to penalize validators who engage in malicious activities or fail to maintain network security. If a validator is slashed, both the validator and their nominators may lose a portion of their staked DOT tokens. It’s crucial to carefully select validators and understand the associated risks before staking.

Before staking Polkadot, it’s essential to conduct thorough research, be aware of the risks involved, and consider factors such as validator performance, commission fees, and the amount of DOT tokens they have already staked.

Where Can I Stake

Are you interested in staking? Let’s talk about the process.

Exchanges

All the technical requirements will be taken care of for you.

The staking rewards are usually distributed at the start of each month.

The leading cryptocurrency exchanges that support staking include:

- Binance

- Coinbase

- Kraken

According to Coindesk, Kraken users are staking more than $1B in crypto. The fast growth of staking value reflects the many long positions of crypto investors.

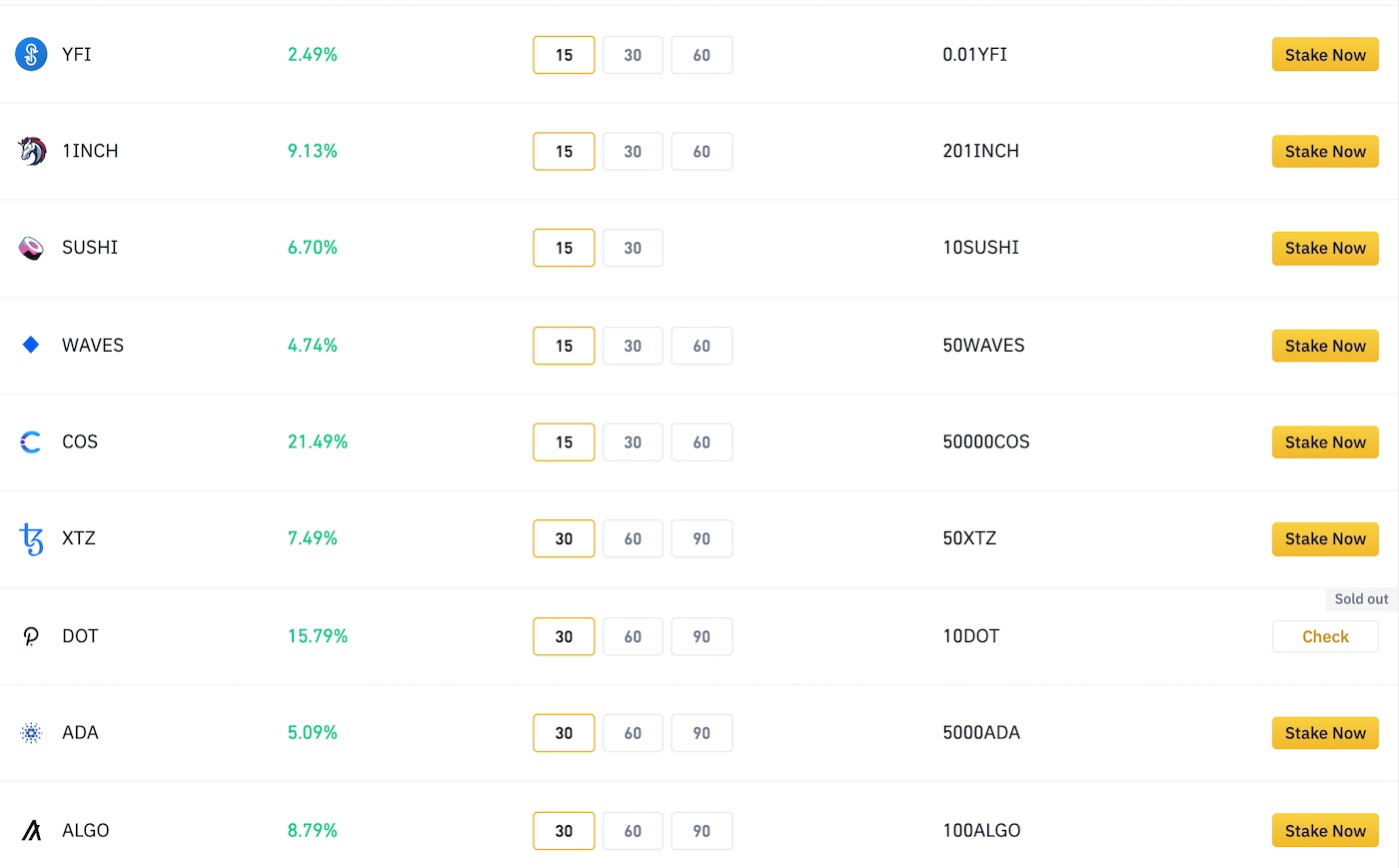

Staking at Binance

Binance staking supports a wide variety of coins that will earn you staking rewards. There are more options for what coin and how to stake.

- DeFi staking – staking DeFi cryptocurrency on a user-friendly platform

- Flexible staking – you can use your coins and trade with them, lower return

- Locked staking – you cannot trade or withdraw your coins, higher return

- 1INCH

- YFI

- SUSHI

- WAVES

- COS

- XZT

- DOT

- ADA

- ALGO

- and others such as ICX, CELR, AVAX, KSM, IOST, CRV, OAX, NAV

Cold Staking

Cold staking is a form of staking that requires you to hold staked coins at the same address on a cold private wallet. You can’t move the coins within a lock-up period otherwise, you lose staking rewards.

The leading cryptocurrency wallets supporting staking include:

- Ledger

- Trust Wallet

- CoolWallet S

- Trezor via third-party apps (e.g. Exodus wallet)

Soft Staking

Soft staking is known as staking as a Service Platforms. This form of staking is dedicated to staking only. You can use the following platforms:

- Stake Capital

- MyCointainer

Future of Crypto Staking

Staking coins gains popularity because it is a quite simple way how to earn a passive income. Proof-of-stake and staking come with an original thought to participate in the consensus and governance of blockchains. Moreover, it provides bonuses for stakers with a reward system.

With the hype around the NFT market, developers and investors look for additional ways how to profit from digital assets. There are many ways how to generate passive income with NFTs. Staking your NFT is one of the most popular strategies for early adopters.

It’s worth saying, though, that crypto staking comes with significant risk. Locking up funds in a smart contract might end up in the loss of your coins due to a bug, hack, or another technical or human failure. Always do your own research and invest your time in due diligence in cryptocurrencies and third-parties projects.

Best Staking Coins 2023

There are many coins to stake and we cover only the best in our view. It is a very dynamic market and you should do your own research before investing. Here is our pick for best staking coins for 2023:

- Ethereum

- Solana

- Avalanche

- Polkadot

- Binance Smart Chain

- VeChain (Don’t miss: VeChain price prediction for 2023 and 2025)

While staking may play an important role in investor’s returns, you shouldn’t choose and stake a cryptocurrency just because of staking returns.

If you find it hard to go through the staking setup process you can start staking on Binance exchange. It is now the easiest way how to stake coins.

Register on Binance via our link and get a 10% discount on trading fees.

Staking can help to lower the volatility in your crypto portfolio and it provides a way to earn a passive income stream.

Happy staking!

Looking for higher profit?

Try a free trial TradeSanta crypto bot for 3 days. It is super easy to set up and based on my experience (TradeSanta review).