Find out the top ways to earn passive income from NFTs through methods like staking, renting, farming, or even investing in NFT coins. Now, you can make your unique digital items work for you.

NFTs are continuing to disrupt the crypto market. There are traditional ways how to earn money with crypto such as investing. This article will go deeper and explore the possibilities of how you can make your unique digital asset work for you without selling your NFTs. The idea behind it is simply to create a passive income using non-fungible tokens.

The NFT market has evolved into a significant part of the crypto business. Ethereum is nowadays used to create, buy and sell the vast majority of NFTs, but the expensive fees make the process pretty expensive.

According to data from Raribleanalytics, minting a single NFT on Ethereum costs roughly $99 in gas expenses. Minting NFT collections on Ethereum costs around $900. Small investors can’t afford to pay transactional fees of around 100 dollars, therefore other blockchains such as Solana, Polygon, and Binance Smart Chain are on the rise. We can expect NFTs to expand to other blockchains and get more popular among the majority of people, not just a crypto community and geeks.

Since we don’t know what the future holds for NFTs we can expect certain milestones to come true in 2022. Let’s dive into the strategy for crypto investors looking for passive income from NFTs.

What are NFTs

NFT has been the buzzword of the year 2021 and continues to be one of the most searchable worlds within the crypto community. NFT has gained popularity not only its technology that can prove digital ownership but also because it can generate good returns.

NFT can be really everything on the internet such as drawings, music, video, articles, trading digital cards, digital items,…Find out more in the article NFT Explained.

How do NFTs work

NFTs are designed to give you something that can’t be copied: ownership of the work. NFTs don’t save the digital entity they represent. Instead, they just direct you to the file’s location, which is elsewhere on the internet. This process is a reason for a big discussion between lovers and haters of NFT technology.

NFTs are fundamentally an ERC721 token on the blockchain. They are tradable digital receipts that everyone can access and independently verify at all times.

6 ways to earn passive income from NFTs

There are a number of ways to generate an income from NFTs than selling them at a higher price than you paid or created them for.

- Invest in NFT coins

- Stake your NFT via DeFi and earn tokens as yield

- Rent out your NFT for passive income.

- Create NFT and receive royalties on each sale

- Add your NFT to the liquidity pool and earn tokens

- Start yield farming NFTs

Best NFT coins for passive income

A guide NFT Investing for beginners should begin with something easy as putting money with one click and doing nothing else.

The most simple way how to make money from NFT is to invest in NFT tokens. Choose one of the popular or rising NFT projects and buy its token on a crypto exchange. Wait until the price of the token get higher and sell with profits.

What are the best NFT coins in 2022

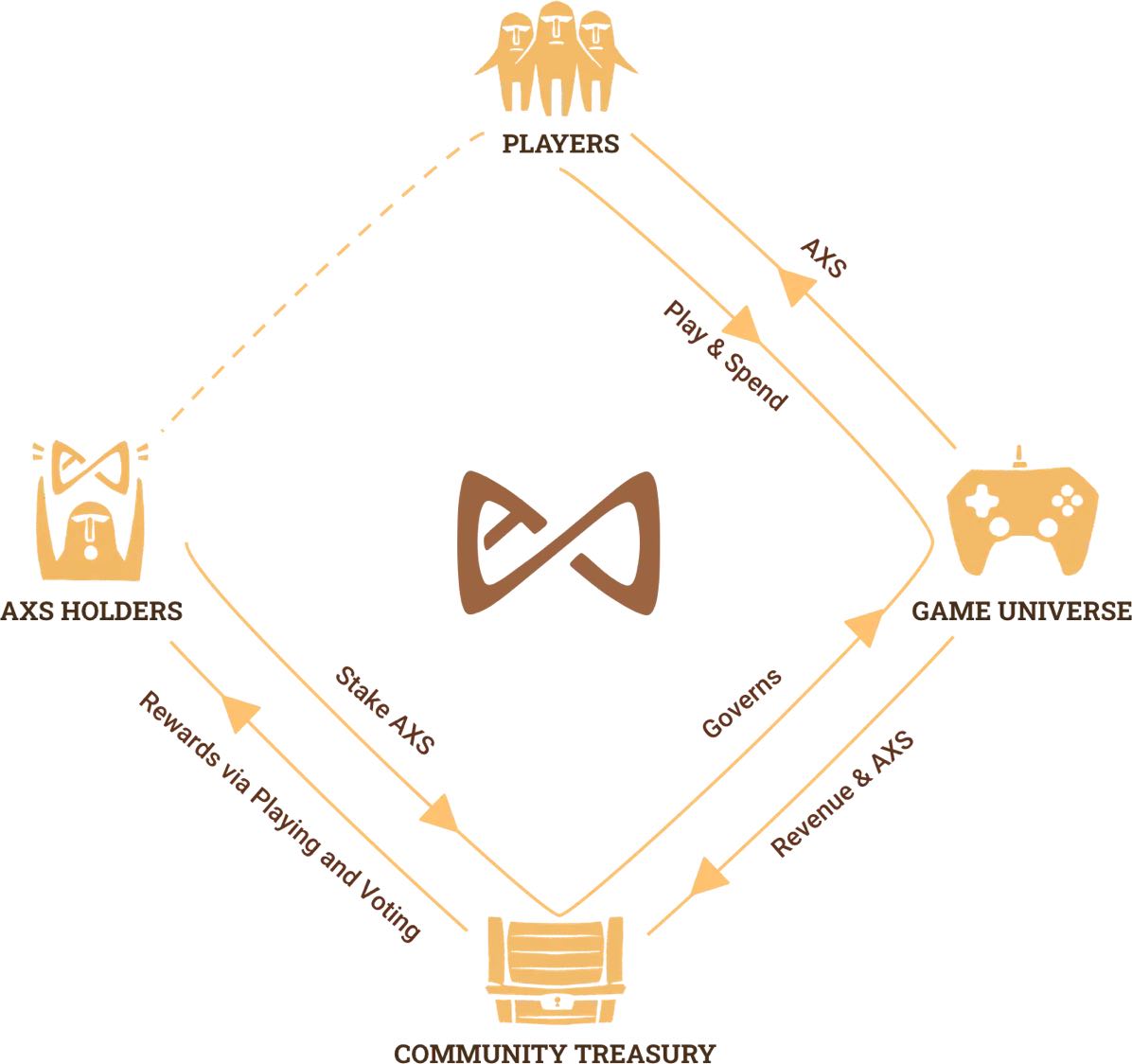

- Axie Infinity – AXS and SLP

- Wolf Game – $WOOL

- Decentraland – MANA

- The Sandbox – SAND

- Enjin – ENJ

- Gala Games – GALA

NFT coins gained huge profits in 2021, especially those connected with metaverse. The year 2022 might be the year of GameFi and Play-to-Earn crypto games so you’d better be prepared with owning real NFTs or NFT coins.

Buy NFT coins via Binance exchange. Register on Binance and get a 10% discount on trading fees.

TRADE ON BINANCEStaking NFTs

One of the many ways to earn more profit with your NFT is staking. NFT staking or NFT farming involves locking up your digital assets on a blockchain protocol or smart contract to yield interest.

Instead of staking coins, you stake NFTs. NFT Staking is beginning to get more traction, especially with game NFT assets.

Many popular NFT arts and NFT game items allow you to stake them so you can gain up to 100% annual percentage yield (APY).

Generally staking NFT is one of the safest ways how to earn additional money while holding a digital asset. On the other hand, smaller NFT holders don’t find more reasons to stake their digital assets, either the returns are very low than selling, and flipping NFTs would be more profitable. It is not a passive income though, that’s true, but crypto investors focus mainly on gaining income.

Where you can stake NFT

Here are some of the leading platforms that support NFT staking.

- Onessus

- Only1

- KIRA (DeFi platform, users receive NFT as rewards)

- Splinterlands (Play to earn game, users receive NFT or tokens)

- NFTX (NFT protocol, users earn trading fees from the platform)

- JustLiquidity

The rarer your NFT, the higher the APY you get.

How does NFT staking work

NFT staking is getting more popular because of the blockchain gaming industry. Play-to-Earn games came with a strategy of their funding via NFT. Players are nowadays rewarded with NFTs.

For example, if you play the P2E game Cryptoblades, you can stake your grade-A blade. The game will lock up the item and pay you SKILL tokens which is a native cryptocurrency of the game.

The idea behind staking rare NFT items in crypto games is to keep them out of circulation and out of the game, so the game developers can make more unique items to bring more players to the game.

Staking is a coming feature in the most popular P2E game Axie Infinity.

Opportunities and risks while staking NFTs

NFT whales or big investors who hold rare digital assets such as Beeple collection or an Angel from Axie Infinity worth 100 thousand USD, don’t put their NFTs for staking. There is no reason for them to stake it and let someone else use it.

It might be hard to tell who will truly benefit from locking away their NFT. Probably middle-class crypto holders.

Renting out NFTs

Let your stale NFTs generate revenue and rent NFTs temporarily! One of the other ways how you can earn passive income is to rent out your NFTs. Since this option is not widespread as staking NFT, many experts predict that it will gain a lot of popularity, especially with play-to-earn games development.

Platforms for renting NFTs

reNFT is a leading platform that allows users to rent or lend NFTs. reNFT is a rental protocol, that enables lending and borrowing of NFTs. See the infographic to get the idea of renting out NFTs.

Daily rates currently vary from 0.002 to 2 wrapped Ethereum (WETH) on average. WETH is the ERC-20 version of Ethereum’s native cryptocurrency, ether (ETH).

The best way to rent, lend, and mortgage NFTs is via platforms such as:

- https://www.renft.io/

- https://vera.financial/

- https://nft.trava.finance/marketplace

Rent NFT in the P2E games

Some game developers build the renting feature in-house so players will be able to rent their digital assets and gain passive income.

For example, the P2E NFT game called Zed Run will enable horse-owners to rent their horse to other players. The prices of great runners skyrocketed so many players can’t afford to pay thousands of dollars for a horse. With this new feature, they will be able to rent a horse and start winning. The owner of the horse will earn passive income, one-time payment, or a share from winnings.

Another great example is renting trading cards. In a P2E game with card mechanics, one player can rent out a valuable NFT card and gain a profit from renting. Another player will use this card for the game and increase his chance of winning.

Royalties from NFTs

Artists and creators can earn passive income from royalties every time their NFT is sold to a new owner. The NFT underlying technology allows to set up a royalty for digital artwork. With this, artists can earn a share of the sale price of the NFTs. This is one of the best opportunities for creative artists on the internet.

How much money you can earn from royalties

The royalty for a digital artwork is set usually between 2% – 15%.

As a creator you don’t need to enforce the royalty terms or track payment and new owners, the whole process is fully automated. It is set up during the creation of NFTs.

NFT royalties are great passive income for artists, graphics, video-makers, and also musicians. As a creative person, you should definitely go down this rabbit hole and find out more about NFTs royalties. It might make you a lot of money. Every art or digital piece that you create is an investment, at some point.

You can also earn royalties by giving someone a commercial license.

Liquidity pool

Add your NFTs to a liquidity pool and earn interest. Similar to the process of staking, liquidity pool is another option for you how you can earn yield in the platform’s native utility token. It is an advanced strategy and it is strongly advised that you only use floor NFTs.

A liquidity pool is simply a collection of digital assets locked in a smart contract that’s pledged by multiple investors. The locked pool of NFTs can be used by the platform for handing out loans.

How does liquidity pool work

First, you put your NFTs to the liquidity vault and you will receive native tokens that represent the share of the vault’s value plus your share of the trading fees generated via the automated market maker (AMM) of the liquidity pool.

Be careful, there is no guarantee that you will be able to get back your original NFT once you unstake from the vault.

An alternative for NFT liquidity pools is NFT loans.

NFT yield farming

NFT farming is one of the latest DeFi trends that combine yield farming with the world of non-fungible tokens (NFTs).

Yield farming with NFTs is a strategy where investor looks to earn returns on top of returns by leveraging yields earned from one platform and investing them in another.

In other words, NFT farming refers to staking an NFT to receive rewards in tokens or staking tokens to receive an NFT as a reward. Unlike in traditional crypto yield farming, where you deposit digital assets into a liquidity pool to receive token rewards, NFT farming involves the use of NFTs instead.

Axie Infinity is a prime example of a blockchain game with NFT farming capabilities. Aside from Axie Infinity there are other DApps that provide NFT farming including Aavegotchi, Mobox, and SuperFarm.

Can you make money with NFT?

NFTs have been known to generate income for investors through trading. Buying low and selling high. The strategy is called flipping NFT. First, you get whitelisted in an NFT project, then mint an NFT and within days or weeks, you sell it for a higher price.

You need to know the market and timing is also very important. For sure, this is active income, because you will spend a lot of time looking for a good NFT project and researching it.

Other methods that include generating passive income from NFTs are:

- Staking

- Renting

- Royalties

- Liquidity pool

- Yield farming

So, now you can answer the question, can make money with NFT. Crypto is really revolutionizing the way how people make an income. Certainly, there are many ways how to earn a lot of money with NFT. Surely, it is not for everyone, and to tell the truth, you must have specific know-how and also have a strategy. Timing the crypto market might help you and give you a bit of luck as well.

Crypto investors can earn a passive income with NFT and you can be now one of them.

How to generate passive income with NFT as a beginner

There are a lot of scammers out there so be aware of what you are buying and where you are buying. NFT marketplaces such as OpenSea are safe, but not all NFTs trading on OpenSea is legit. Before you jump into NFTs, make sure you do your own research.