eToro is the world’s leading social trading platform, offering a wide array of tools to invest in the capital markets. You can quickly create a portfolio of stocks, commodities, ETFs. Moreover, you can trade with cryptocurrencies such as bitcoin, ethereum, ripple and other altcoins. There are over eight million registered users on eToro. The platform has experienced exponential user growth since 2017, undoubtedly because of cryptocurrency demand. Below is our review of eToro and a comparison with other cryptocurrency exchanges. We will explain why investors and traders tend to use eToro, what the user experience is like for them and if eToro is a good choice for you.

What is eToro

eToro was founded in 2006 by two brothers, Ronen and Yoni Assia with David Ring as their partner. The company began as a general trading platform under the RetailFX brand. In 2010, eToro opened a social investment platform with the CopyTrading feature.

eToro’s brokering services are provided by eToro (Europe) Ltd. The main development is located in Tel Aviv, Israel. eToro’s legal entities (eToro Europe Ltd. and eToro UK Ltd. is authorized and regulated by CySEC or FCA.

eToro was the first company that started to offer bitcoin trading via CFDs in 2013. It has become one of the earliest players in the world of crypto investments.

Is eToro legal to use in your country?

eToro cannot be legally used in the United States, Canada, Cuba, Japan, North Korea, Iran, Syria, Turkey, Serbia, Albania, and Sudan. The platform is blocked due to changes in the regulations that conflict with trading laws. For the remaining 140+ countries, eToro is open and active. The most significant market is Great Britain followed by countries in Europe.

eToro investment platform will launch into the United States soon, said CEO of eToro Yoni Assia at Consensus 2018.

eToro participates in many crypto-related conferences, such as the Crypto Investor Show 2018 in London.

Cryptocurrency support

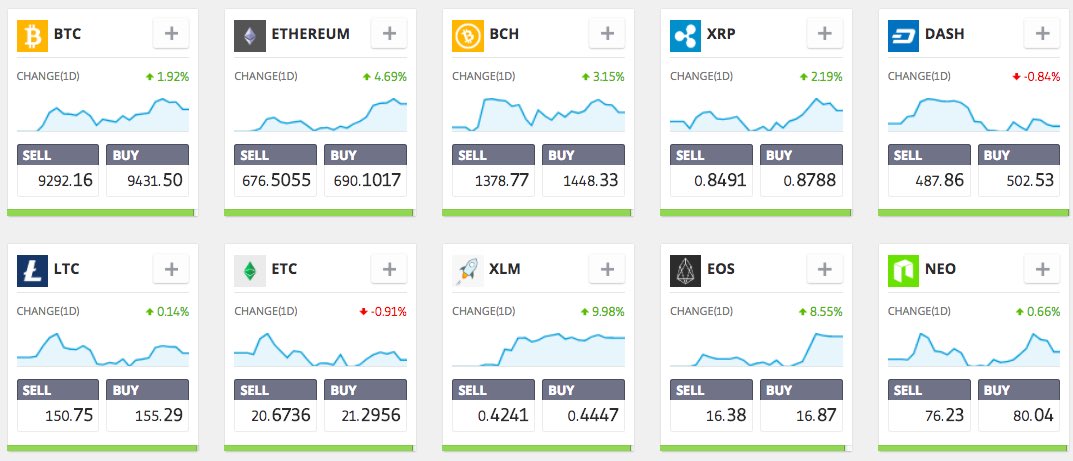

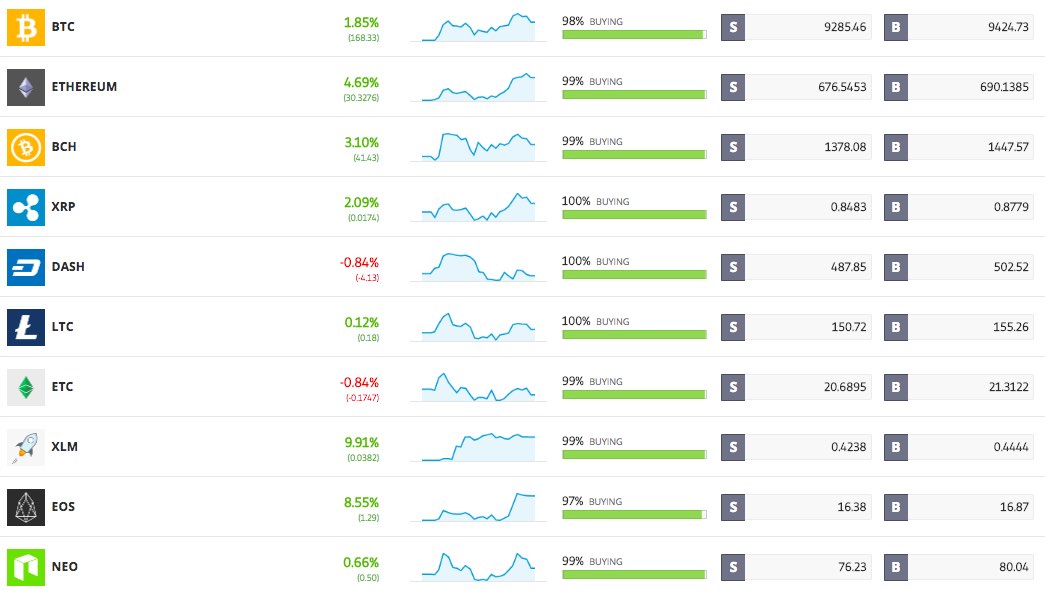

eToro is not a dedicated-cryptocurrency exchange and therefore only a handful of cryptocurrencies are tradeable. The eToro team is working hard on including more cryptocurrencies and increasing their already decent collection of tradable altcoins.

Below is a list of cryptocurrencies that can be traded on the eToro platform:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Ripple (XRP)

- Dash (Dash)

- Litecoin (LTC)

- NEO (NEO)

- Stellar (XLM)

- EOS (EOS)

What Are Crypto CopyFunds?

Crypto CopyFunds exist to make investments more accessible for beginners and non-professionals. A CopyFund is a single tradeable asset that is made up of various assets, preselected by a particular strategy or a person. To demonstrate, imagine a basket with various top-performing cryptocurrencies. Almost like investing into single cryptocurrency, with Crypto CopyFund you can invest in a basket full of different cryptocurrencies.

CopyFunds were added to the eToro platform in 2017, and apparently, it’s one of the factors fuelling demand.

CopyFunds aim to help investors promote opportunities for growth by creating diversified investments.

There are several cryptocurrency CopyFunds available for investors nowadays.

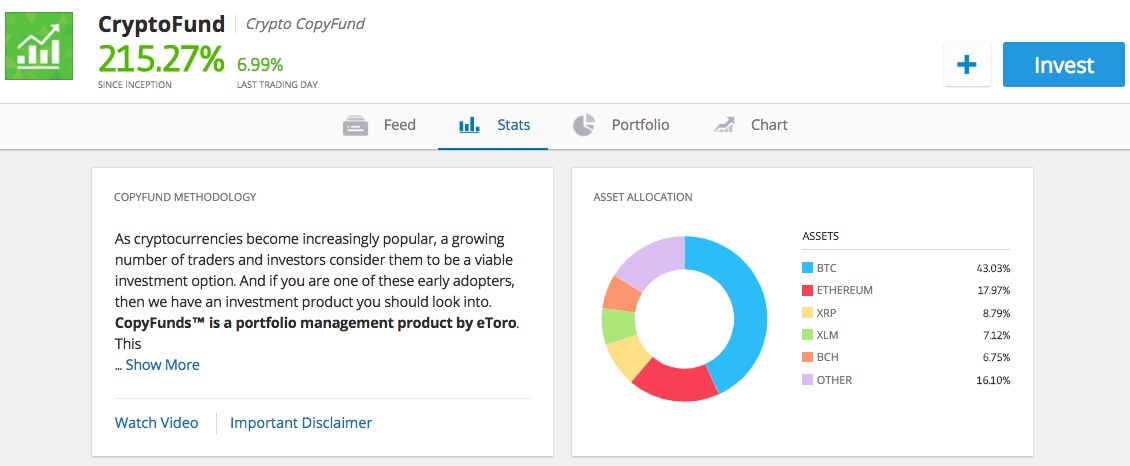

CryptoFund

CryptoFund started in August 2016 and since its inception has made 215% in profit. More than 40% of the portfolio is in Bitcoin, but the rest is divided into other cryptocurrencies, such as Ethereum, Ripple, Bitcoin Cash, etc.

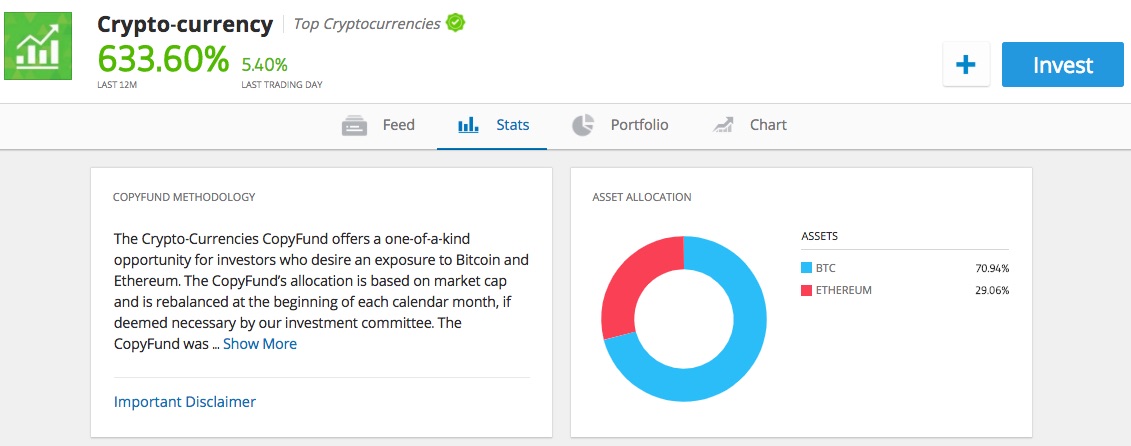

Crypto-currency fund

Another CryptoFund available on eToro is called Crypto-Currency Fund. It began in April 2017, and gained more than 633% in value in the past 12 months. It is only focused on bitcoin and ethereum.

What Is CopyTrading?

CopyTrading is a very popular feature for non-professionals because it lets you copy traders of your choice. The best part of it is the statistics. Filter the top performance traders and simply copy them. eToro will automatically copy all their trades with the amount of money that you put in. Finally, you can diversify among as many traders as you want to.

From now on, you don’t need to do any technical research or market analyses. You can just pick and follow the best traders on the platform. This is social trading, a new way of investing.

“It’s like having thousands of traders, all working for you!” said Yoni Assia, CEO and Founder of eToro.

CopyTrading sounds very catchy because many new investors imagine passive income. But the truth is that a historical profit and statistics don’t guarantee future performance. We highly recommend starting with a demo account where you trade with virtual money (hence neither fiat money nor cryptocurrency). You can start copying some traders and see their performance over time directly in your account.

Minimum investment for cryptocurrencies

The minimum investment amount for cryptocurrencies is $200. However, you can choose to deposit $100 on eToro; you just have to set up the leverage of x2 or higher.

If you want to participate in CopyTrading, you must enter at least $200. For CryptoFunds the minimum investment is $5000.

Fees

Cryptocurrencies can be traded 24/7, hence there are no market hours. The fee structure varies from asset to asset, but regarding cryptocurrency trading, in particular, eToro has one of the highest fees on the market.

Bitcoin trading costs 1,5% and for other digital currencies the fees are even higher, 2% – 5%. See the detailed table with trading fees.

| Instrument | Market Hours | Daily Break | Spread | SELL | BUY |

|---|---|---|---|---|---|

|

Bitcoin

|

24/7

|

1.5 % | -0.471233 | -0.471233 | |

|

Bitcoin Cash

|

24/7

|

5 % | -0.14 | 0 | |

|

Dash

|

24/7

|

3 % | -0.039452 | 0 | |

|

EOS

|

24/7

|

3 % | -0.00125 | 0 | |

|

Ethereum

|

24/7

|

2 % | -0.036712 | -0.036712 | |

|

Ethereum Classic

|

24/7

|

3 % | -0.001726 | 0 | |

|

Litecoin

|

24/7

|

3 % | -0.006575 | 0 | |

|

NEO

|

24/7

|

5 % | -0.012383562 | 0 | |

|

Stellar

|

24/7

|

5 % | -0.0000416 | 0 | |

|

Ripple

|

24/7

|

3.5 % | -0.000022 | 0 |

Above all, the minimum withdrawal amount is $50. The withdrawal fee is $25. This is an extra high one-time fee for cashing out.

Insane inactivity fee

Honestly, we don’t like the inactivity fee that eToro started to apply. When an account has been deemed inactive, a monthly inactivity fee to the tone of USD $5 will be charged. ‘Inactivity’ means no login from the user for 12 months for depositing accounts, four months for non-depositing accounts. Apparently, you cannot end up with a negative balance. Check back once in a while, you don’t want to lose your money just because you didn’t log in for four months.

Deposits and withdrawals on eToro

The minimum first-time deposit starts mostly at $200. You can choose to deposit via wire transfers, bank transfers, debit and credit cards (Visa or MasterCard), PayPal, Skrill, and others.

Depositing money into your account is private and secure. All transactions are communicated using Secure Socket Layer (SSL) technology, ensuring that your personal information is kept safe.

To withdraw your money, you first need to fill out a form and provide:

- a copy of your signature,

- a color copy of your passport,

- and a proof of address.

You don’t own the coins on eToro

Please be aware, that eToro is a CFD platform, it is not a real cryptocurrency exchange. That being said, you don’t have access to coins even if you buy them on eToro. You cannot send them to your wallet. Actually, you cannot buy them, you only speculate on the USD value of the cryptocurrencies.

It can be a little bit confusing, especially for beginners and the buttons saying Buy/Sell. Once again, you don’t buy cryptocurrencies on eToro, you speculate on the price. In other words, you sell or buy a certain number of units for that instrument (cryptocurrency) based on your prediction of if the price will rise or fall. Finally, you cannot withdraw any cryptocurrency.

If you are looking for a cryptocurrency exchange, not CDF platform, check our TOP cryptocurrency exchanges or read the full Binance exchange review.

Customer Support

Toro’s customer support is available 24/5, from Monday to Friday. Unfortunately, they don’t have a live chat function. Based on our experience the response time via email is up to 48 hours. You can contact them via phone as well. Moreover, they provide an extensive FAQ and documentation.

Online negative reviews on eToro

Looking for public reviews on social media and forums, customer support is one of eToro’s weaknesses. In general, cryptocurrency exchanges have a bad reputation for customer support and eToro is no difference.

Conclusion: Is eToro a good place for your cryptocurrency trading?

eToro provides one of the most user-friendly platforms for cryptocurrency trading. It is simply a joy to use. Visualization, graphs, and the UX in general in both the desktop and mobile versions is perfect. Furthermore, you can trade not just bitcoin but also quite a variety of altcoins that give you a great taste of speculation and diversification.

Also, CopyTrading and CopyFunds are very useful and appealing features that attract many new investors.

Liquidating the crypto assets is unpleasant because any withdrawal is connected with quite a high fee. Even trading on eToro is more expensive (fees for initializing positions and closing positions). That’s the biggest turnoff for many experienced traders and crypto enthusiasts. Don’t forget; you can only cash out fiat currencies, not cryptocurrencies!

Customer support isn’t great either, and you can experience some delays in the transfers of your funds. In comparison to other major cryptocurrency exchanges, eToro’s reputation isn’t significantly worse in this respect.

To summarize, eToro is not the right place if you want to buy and sell alternative cryptocurrencies or if you are an advanced trader. On the other hand, eToro attracts, and it is a perfect match for those who are new in the space and want to get a taste of cryptocurrency trading. It provides an intuitive and smooth platform for speculating with various trading features.

Important: 67% of retail CFD accounts lose money.

Have you tried eToro yourself? We’d love to hear what you think about it in the comment section below.